جدیدترین اسپیلاوایزر

بیشتر-

خرید کمربند بادی جاانداز دیسک کمر OEM

6,500,000تومان5,850,000تومان -

آداپتور 12 ولت مخصوص زانوبند | کمربند|گردنبند اسپیلاوایز | زاپیامکس | پلاتینر

400,000تومان -

گردنبند طبی ترمو-مگنتیک آرترونیس|درمان آرتروز گردن

4,000,000تومان3,590,000تومان -

خرید زانوبند ترمو-مگنتیک آرترونیس| درمان آرتروز زانو | با گارانتی یکساله|درمان 100%

4,500,000تومان3,970,000تومان -

خرید کمربند ترمو-مگنتیک آرترونیس| درمان دیسک کمر|رقیب پلاتینر- تیلاکس پرو

4,500,000تومان4,100,000تومان

How to Automate Your TradingView Strategy|100%

:Introduction to Automate Your TradingView Strategy

فهرست مطالب

TradingView is a popular platform for analyzing financial markets and charts, but did you know that you can also learn How to automate your tradingview strategy? Automating your strategy can save time, reduce emotions, and potentially improve your trading performance. In this comprehensive guide, we will walk you through the step-by-step process of automating your TradingView strategy in a simple and easy-to-understand language.

- How to Automate Your TradingView Strategy

Step 1: Creating a TradingView Account

To begin Tradingview Binance Automated Trading , the first step is to create an account on the TradingView platform. Visit the TradingView website and sign up for an account if you don’t have one already. It’s a straightforward process that requires basic information. Once you have your account, you’ll have access to a wide range of charting tools and

indicators that will help you develop and automate your trading strategy.

Step 2: Defining Your Trading Strategy

Before you can automate your strategy, you need to define it. Determine the rules for when your bot will buy and sell assets. This could be based on technical indicators, price movements, or other criteria. Think about the specific conditions that need to be met for a trade to be executed. Consider factors such as entry and exit points, stop-loss levels, and profit targets.

When defining your strategy, it’s important to consider your risk tolerance and financial goals. Are you a day trader looking for short-term gains, or a long-term investor seeking to build wealth gradually? Understanding your objectives will help you design a strategy that aligns with your trading style and objectives.

Step 3: Backtesting Your Strategy

Once you have defined your trading strategy, it’s essential to backtest it to see how it would have performed in the past. Backtesting allows you to evaluate the effectiveness of your strategy and make any necessary adjustments. TradingView provides tools for backtesting, which can help you assess the profitability and reliability of your strategy.

To conduct a backtest, you’ll need historical price data for the assets you want to trade. TradingView offers access to a vast library of historical data for various markets. You can select the time frame and assets you want to test and run the backtest to see how your strategy would have performed. Analyze the results to identify strengths and weaknesses in your strategy.

During the backtesting phase, it’s important to be mindful of potential biases. Keep in mind that historical performance does not guarantee future results. While backtesting can provide valuable insights, it’s essential to continuously monitor and adapt your strategy as market conditions change.

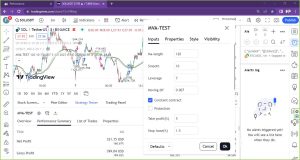

- Backtesting Strategy in Tradingview | How to Automate Your TradingView Strategy

Step 4: Using TradingView Bots and Alerts

While TradingView doesn’t directly support automated trading, you can still automate parts of your strategy using bots and alerts. Bots are powerful tools that execute trades based on signals from TradingView’s indicators or preselected strategies. You can find both free and paid bots with customizable features.

To create a bot, you can use TradingView’s built-in programming language called Pine Script. Pine Script allows you to define your criteria and build custom indicators, signals, and trading systems. If you’re not familiar with coding, you can also explore existing bots created by other traders on the TradingView platform. These bots can be customized and integrated with your strategy.

TradingView alerts are another tool you can use to automate your strategy. Alerts notify you when specific conditions are met on a chart. For example, you can set an alert to notify you when the price of an asset reaches a certain level or when a specific technical indicator generates a signal. You can configure alerts to be delivered via email, SMS, or push notifications on your mobile device. Utilizing alerts helps you stay informed, identify trading opportunities, and improve your decision-making process.

Step 5: Integration with Third-Party Automation Services

To fully automate your TradingView strategy, you can integrate it with third-party automation services. These services provide additional flexibility and control over your trading. Some popular options include Apitrading, 3Commas, Cryptohopper, Gunbot, Mudrex, and Quadency. These platforms offer features like copy trading, backtesting, and real-time trading.

When selecting a third-party automation service, consider factors such as compatibility with TradingView, ease of use, available features, customer support, and pricing. Each platform has its unique strengths and weaknesses, so it’s essential to evaluate them based on your specific requirements.

Integrating your TradingView strategy with a third-party automation service typically involves connecting your TradingView account to the service using the respective APIs or integration methods. This allows the automation service to receive signals from TradingView and execute trades on your behalf. The process may vary depending on the platform you choose, so make sure to follow the instructions provided by the service.

Step 6: Monitoring and Evaluating Performance

After deploying your automated strategy, it’s crucial to regularly monitor and evaluate its performance. Keep an eye on the trades executed by your bot and analyze the results. Monitoring allows you to identify any issues or areas for improvement. Make adjustments to your strategy if necessary, based on the performance and market conditions.

Regularly review key performance metrics such as profit and loss, win rate, average trade duration, and drawdown. Compare these metrics against your backtesting results to ensure that your strategy is performing as expected. If you notice significant deviations or consistent underperformance, consider making refinements to your strategy or seeking professional advice.

In addition to monitoring performance, it’s also important to stay updated on market trends and news that may impact your strategy. Keep an eye on economic indicators, company earnings reports, and other relevant events. Adjust your strategy accordingly to adapt to changing market conditions and maintain a competitive edge.

:Conclusion

Automating your TradingView strategy can be a game-changer in your trading journey. By following the step-by-step process outlined in this comprehensive guide, you can save time, reduce emotional decision-making, and potentially enhance your trading performance. Remember to define your strategy, backtest it, utilize TradingView bots and alerts, integrate with third-party automation services, and consistently monitor and evaluate your strategy’s performance. With dedication and careful analysis, automated trading can be a valuable tool to achieve your financial goals.

However, it’s important to note that automated trading involves financial risks, and it’s crucial to thoroughly understand the strategies and tools you are using. Always conduct thorough research and exercise caution when implementing automated trading systems. Keep learning and adapting your strategy as the market evolves. With discipline and continuous improvement, you can harness the power of automation to potentially increase your trading success

مرتبط ها

دیدگاه شما

آدرس ایمیل شما منتشر نخواهد شد. قسمتهای مورد نیاز علامت گذاری شده اند-

گردنبند طبی ترمو-مگنتیک آرترونیس|درمان آرتروز گردنفروش ویژه محصول تخفیف خورده

4,000,000تومان3,590,000تومان